Why now?

“Invert, always invert.“

Charlie Munger 1924-2023

There is nothing wrong with admitting that you don’t know something. What makes investing so fascinating and sometimes frustrating is not knowing all the answers. Explaining market movements is never simple. Some price changes appear illogical, even irrational, whether it is the rise of the stock market on the day of a missile attack on Iran or the sharp share price fall on blow-out quarterly profit numbers.

One issue has been vexing investors in the past quarter. It is not, ‘why is the S&P500 index making new all-time highs?’ No one questions rising stock markets; they are considered a given these days. No, the unanswered, unfathomable question is why is the gold price making new all-time highs? This has perplexed many, and not merely those that believe gold is a barbarous relic with no intrinsic value. Even long-in-the-tooth strategists and gold analysts are joining in with the collective head scratching over the recent price rise. We suspect there are several reasons for savers to be prepared to pay more for an ounce of the yellow metal today, but we would not begin to pretend to be omniscient on this matter.

Troy ounces

We have held exposure to gold in Personal Assets Trust(‘PAT’) since we were appointed as Investment Adviser in March 2009, initially via a physically-backed ETC. The gold price back then was $919oz (£642). Today, PAT holds gold bullion via an allocated account which carries a slightly cheaper cost for the Trust. Today’s price is $2320oz (£1900), representing a compound return in sterling of 7% per year since March 2009.

Remarkably, and surprising to many, gold has outperformed the S&P 500 index this century. It has contributed to our positive returns and, despite some inevitable bumps along the way, has provided valuable diversification, reduced portfolio risk and given us essential portfolio insurance over the past 15 years. Gold exhibits volatility similar to that of equities but performs a very different function. This is most apparent at times of market stress, whether during the Global Financial Crisis of 2008 or in 2020 when the pandemic hit. This has a value to us and, unlike other forms of portfolio protection, the cost of ownership is very low.

Many a conspiracy theorist enjoys holding forth on the subject of gold. We prefer to focus our attention on the actions of rational savers and investors. Just as the stock market is a voting machine in the short run and a weighing machine in the long run, so too the gold price will misbehave in the short term whilst proving instructive over longer time periods. Our rationale for owning it has nothing to do with short-term price movements. Rather, it is rooted in gold’s continued substance and scarcity in an increasingly financialised world.

Valuation metrics fail

We have not been taken aback by the rise in the price of gold this year. For much of last year we pointed out to clients that gold was making new highs in sterling, euros and yen. The US dollar had hitherto been the exception, but it was probably only a matter of time before it followed other currencies.

‘Why has gold performed strongly’ is likely the wrong question to ask. Rather, we should invert, as Charlie Munger tells us to, and ask why these currencies are falling, relative to gold? For all the puzzlement and confusion over the gold price, perhaps we ought to accept that savers are simply looking for protection. One should not be obsessed about rationalising short-term swings in the price; rather, one should focus on the role that gold can play, and has played, in portfolios over the longer term.

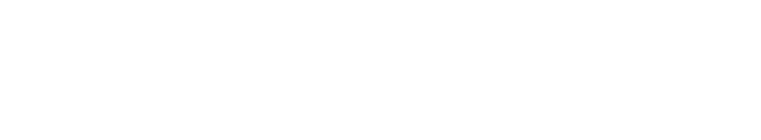

In 2023, in a strongly rising interest rate environment, the consensus expected a zero-yielding asset to hold no merits, thus leading the price of gold to fall. Zero interest rates and even negative yielding bonds, which in 2020 reached $18tn in value, supposedly offered support. Without these props in place and real yields also rising, there was surely too great an opportunity cost in holding the metal. Charts (see Figure 1 and Figure 2) provided strong indications of correlation, but these relationships have since broken down. Yet making these connections and correlations – simply put, rates up/gold down – assumes, somewhat naively, that the gold price is set exclusively by western investors. Those with longer memories will recall that sharply rising interest rates and rising bond yields in the second half of the 1970s, did not stop the price of bullion rising from $100oz to $850oz.

Figure 1 – Gold vs US Real Yields

Source: Bloomberg, 22 April 2024. Past performance is not a guide to future performance.

Figure 2 – Gold vs Negative Yielding Debt

Source: Bloomberg, 22 April 2024. Past performance is not a guide to future performance.

Go East

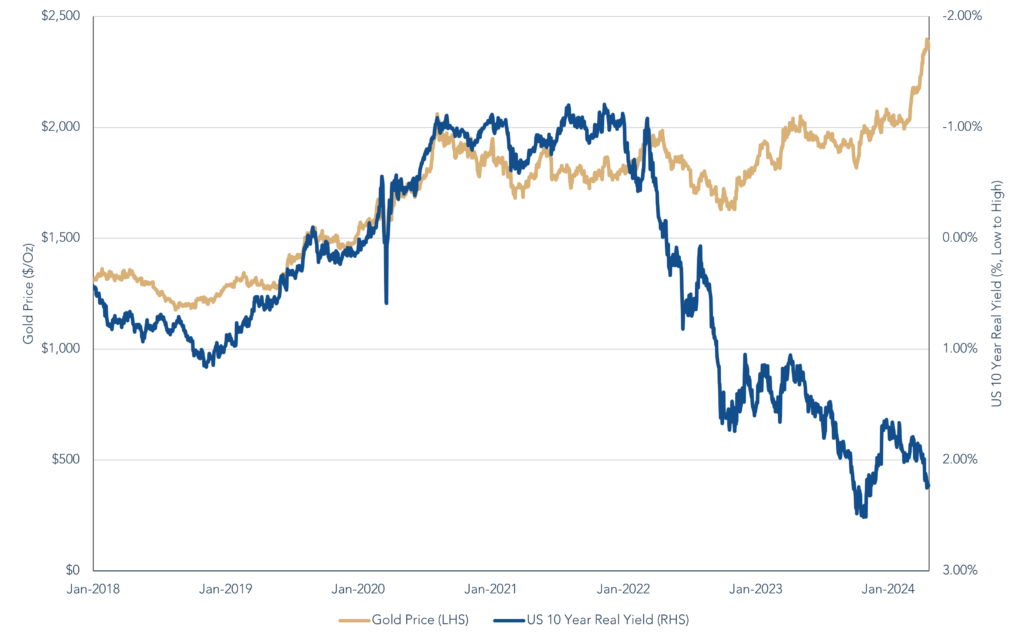

Gold means different things for different people. For the past four years westerners have been selling their gold ETC holdings (see Figure 3). Holdings have fallen by 800 tonnes, down 20% from their peak. There is strong evidence that this gold has been heading east, especially to China. Central banks have been buying consistently since 2022, particularly the People’s Bank of China (PBOC). Others including Poland, Singapore and Turkey are also known to have added to their reserves. According to Grants Interest Rate Observer, the PBOC bought 735 tonnes in 2023 (two thirds of purchases were not disclosed in official holdings). Chinese private sector net imports were 1,411 tonnes in 2023 and 228 tonnes in January 2024 alone. It seems individuals in China have lost faith in the residential property market and the domestic stock market has failed to deliver consistently positive returns. There is ongoing concern that China’s currency will need to devalue against the dollar. China (wisely) bans trading in cryptocurrencies, so gold is widely accepted as a store of value.

Figure 3 – Gold ETF Holdings (Tonnes)

Source: World Gold Council, 31 March 2024.

Gold appears to be heading into safer hands. Central banks do not trade their reserves regularly and tend to have prolonged periods of buying or selling. Private individuals also typically buy and hold, taking ounces out of the market for long periods of time. ETC holders by contrast tend to trade. It seems likely that Central banks’ buying of gold will continue, given a broader trend of de-dollarisation. At the outbreak of the invasion of Ukraine in 2022, the West immobilised $350bn of Russia’s foreign exchange reserves. By weaponising the dollar in this way, many countries which are not closely aligned to the United States are reconsidering their commitment to dollar reserves.

Fiscal incontinence & monetary gymnastics

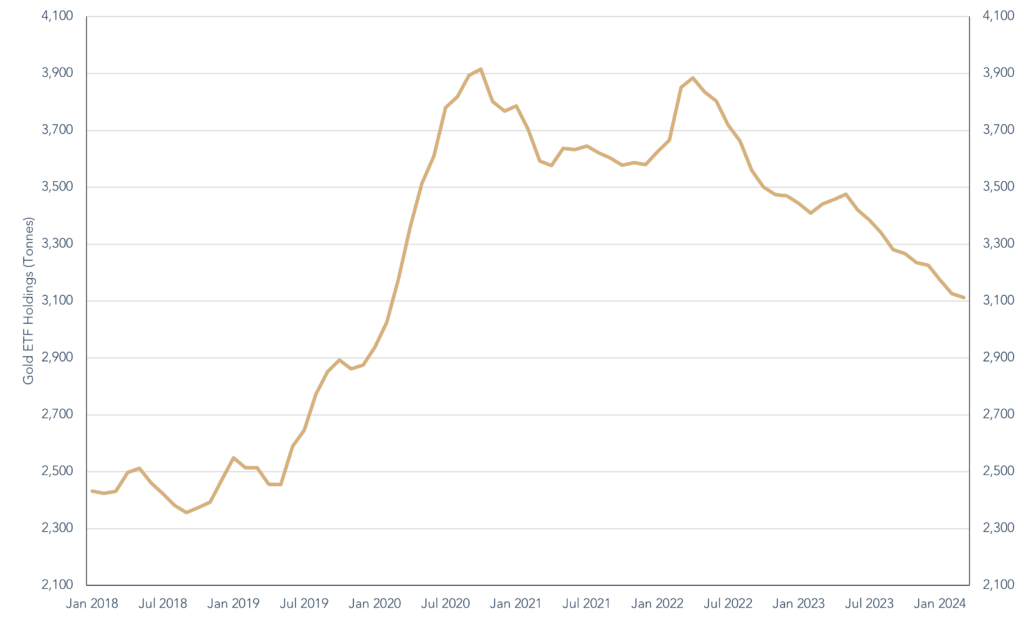

Russian sanctions are not the only possible reason for gold’s improved performance of late. In a post-pandemic economy, there is concern over sustained, sticky inflation that is underpinned by a reversal of globalisation. Inflation has also been driven in part by greater fiscal stimulus in the US which looks to be reaching unsustainable extremes. Higher interest rates are significantly increasing the burden of servicing a large and growing US fiscal deficit. According to the Congressional Budget Office, the interest on $34tn of government debt has risen from $300bn a year in 2020 to over $800bn, a figure that exceeds the defence budget. Moreover, with a deficit currently running at 6% of GDP, the debt figure is rising at $1tn every 100 days (see Figure 4). This deficit would usually be unheard of in peacetime. The US debt situation is perhaps another reason why international investors and central banks are seeking to diversify their reserves held in US treasuries.

Figure 4 – Federal Debt as & of GDP

Source: fred.stlouisfed.org/series and www.cbo.gov/data/budget-economic-data#2, 31 March 2024. *2024 to 2054 data is an estimate.

The US government simply cannot afford interest rates much higher than current levels. This places the Federal Reserve in an invidious position. With its credibility in question after its ‘transitory’ error on inflation, the Fed will be under pressure to compromise between its inflation target and interest rates. It may be forced to lower rates to avoid interest costs spiralling out of control, before its inflation-fighting work is done.

Long-term demand for gold should also be underpinned by the sheer growth in G7 central bank balance sheets since the global financial crisis. According to Jefferies, balance sheets of the Fed, ECB and Bank of Japan have risen from $5.5tn in March 2009 when quantitative easing (QE) kicked off to $25tn in February 2020 and have fallen modestly to $20tn today. This increasingly aggressive monetisation was flagged as temporary as we exited the financial crisis but looks anything but 15 years later!

Mounting tension

The final, potential contributory factor to the gold price is rising geopolitical tensions. Markets have a tendency to ignore such risks until they are staring them in the face. Whether it is the war in Ukraine, now funded by Congress to the tune of $61bn, or the Middle East, such conflagrations are inflationary. They also place further pressure on strained government budgets. These events have resulted in a spike in the oil price and other commodities, as well as adding to the cost of trade. One Chief Executive from a FTSE 100 company informed us recently that just when inflationary pressures seemed to be easing, the cost of shipping spiked. While markets may be hoping some of these ongoing tensions are abating, the risk of a second round of inflation remains. Our fear is the geopolitical risks are turning into realities and will play a greater role in markets in the future.

Gold on crack

We are occasionally asked by clients why we have never held other precious metals. The answer is simple. Palladium and platinum are very narrow, illiquid markets. Silver is more liquid but still only trades 1/8th the value of gold daily. It is also an asset that can be highly volatile and even more unpredictable. Unlike gold, it does not serve the traditional market as Central Bank reserves or as a store of value globally. Gold is the gold standard for precious metals – it is highly liquid with $160bn traded daily (Source: World Gold Council). Silver may have some industrial uses but, as a wealth preservation vehicle, it has no appeal to us. It is for trading and speculating, not for holding and owning.

Uncommon Sense

We continue to own gold as a core part of PAT. We see an increasingly unpredictable world where the need to hold an uncorrelated store of value is greater than in the past. Even better if that asset pays you to own it, as gold has done this year. We recently published a Multi-Asset paper on the value that gold brings to the portfolio for those looking to read more on the subject.

Charlie Munger, Vice Chairman of Berkshire Hathaway, died last November, a month before his 100th birthday. He left behind a gold mine of wisdom about investment and life. Like many, we have been inspired by Munger’s teachings, especially his belief that “acknowledging what you don’t know is the dawning of wisdom. [There are ] three baskets for investment yes, no and too tough to understand. If something is too hard, we move on to something else. What could be more simple than that?” At Troy, we have always been discerning and never felt the need to invest in everything. Instead, we are happy to admit what we don’t know and will continue to keep things simple in a belief that doing so ultimately leads to better returns.

Please refer to Troy’s Glossary of investment terms here.

Performance data relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Past performance is not a guide to future performance. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the investments will be met. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation.

Please note that the Personal Assets Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

Issued by Troy Asset Management Limited (registered in England & Wales No. 3930846). Registered office: 33 Davies Street, London W1K 4BP . Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training.

© Troy Asset Management Limited 2024