Discount Control Mechanisms

Keeping Control

The discount is voluntary

Robin Angus, Director of Personal Assets Trust 1984-2020

With the recent publication of A Shared Journey, an Anthology of Personal Assets Trust Quarterly Reports, this seems like an appropriate moment to revisit one, and arguably the greatest, of the many contributions made by Robin Angus to the Trust and wider investment company sector: the ‘Discount Control Mechanism’ (‘DCM’).

Troy and the Board of Personal Assets Trust (‘PAT’) receive several letters and emails each year asking why we maintain the DCM. We recently even received the suggestion that we should stop issuing new shares in PAT and allow the Trust to trade on an expanding premium, thereby allowing existing shareholders to exit at an inflated price! Those who study Robin’s writings will know that, whilst such a decision might well provide a temporary uplift in the share price, the long term, and investing on behalf of the long-term shareholder, has always been PAT’s priority. Thanks to the DCM, PAT’s share price will move up and down in line with its net asset value (‘NAV’) – no more and no less – over the long run.

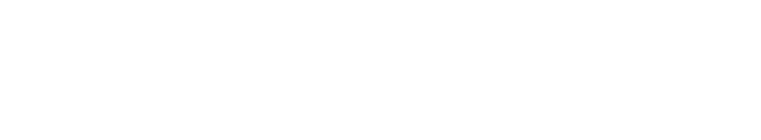

The aim of this Special Paper is to explain the merits of the DCM for investment trusts, and why it is particularly appropriate for PAT. After a year where investment companies’ collective discounts to NAV have widened sharply (see Figure 1) DCMs are as relevant as ever.

Discount Freedom Day

First, some ancient history. PAT introduced its DCM in November 1999, following the changes made to the Companies Act which allowed investment companies to buy back shares more tax efficiently. Before then, companies had been permitted to buy back shares for cancellation only by using revenue reserves, which were ordinarily utilised for smoothing dividend income. Directors were therefore understandably reluctant to use revenue reserves for buybacks. When the law changed on ‘Discount Freedom Day’, as Robin called it, an investment company was permitted to distribute realised capital profits by way of a redemption or purchase of its own shares. Companies could hold shares in Treasury and then subsequently reissue them. This, as Robin described it at the time, was “the best thing to happen to the trust sector since 1979 and 1980, when exchange controls were abandoned and capital gains tax within trusts’ portfolios was abolished in the first year of Mrs Thatcher’s rule.”

This change not only permitted trusts to buy back shares at discounts, thereby enhancing their NAV; it also made it possible to abolish the discount altogether, ensuring that a trust’s share price traded consistently close to its net asset value per share. Yet today, many trust boards overseeing liquid portfolios remain prisoners of their own discount and believe they can do little about it.

The DCM, in Practice

Since 1999, the Board of PAT had been responsible for setting the specific parameters under which the DCM operates. These include the level of discount and premium at which the shares are either bought back or issued. In June 2008, the Board went a step further, enshrining the DCM into the Company’s Articles of Association with a view to “outlawing the discount”. The DCM, now established, can only be reversed at the behest of our shareholders.

There was at that time, and remains, a long history of investment trust directors failing to meet promises to reduce their discount. Some trusts seem happy to issue shares when they trade on a premium but are more reluctant to buy them back when they trade below NAV. When markets become difficult, performance wanes or an investment mandate becomes less fashionable, it is easy to renege on prior commitments to shareholders. The market, however, is unforgiving. Broken pledges of this nature tend to undermine credibility, which in turn can lead to further steepening of the discount.

But I Love a Discount!

Many years ago, not long after Troy had been appointed as Investment Adviser to PAT, I met a private investor who said he liked investing in investments trusts. He also appreciated PAT’s capital preservation mandate but could not bring himself to pay a modest premium for the shares. I explained how the DCM worked, and he was disappointed, saying that he would wait for the shares to trade on a discount. I suggested that he might be waiting a while!

There is a small yet loud minority for whom the discount is a pre-requisite for investment. These are the traders, speculators and arbitrageurs who, by definition, tend not to be long-term investors. Rather, they are brokers thriving on portfolio activity, or arbitrageurs buying with a view to selling as soon as the discount has closed. They are often short-term and not interested in the Trust’s underlying investments. Most importantly, their aims and aspirations are not aligned with those of long-term shareholders. Trusts with DCMs, like PAT, tend not to attract this part of the market because there is no discount to play with.

Corporate financiers rarely advocate for a DCM. Their job, as it was once explained to me, is to ‘hatch, match and dispatch’ investment trusts or, in other words, to facilitate the IPOs, mergers and winding-up of trusts. The more activity the better. The same corporate broker said to me that PAT was ‘just weird’, and that the DCM would not work for other trusts. Perhaps this was because it was not in his interest. After twenty years, the evidence is there for all to see and I am pleased to say that a select few other investment trusts have followed, introducing their own DCMs with success.

A premium is just as bad. Excess demand pushes shares to a premium, in the same way that excess supply leads to shares trading on a discount. The outcome is exaggerated price movements in both directions, leading to undesirable volatility. As Robin reminds us, “Making up a loss of value caused by a change in rating from a 10% premium to a 10% discount is very hard indeed.” Our experience shows that a high premium, however desirable, is rarely sustained.

Shrink to Grow

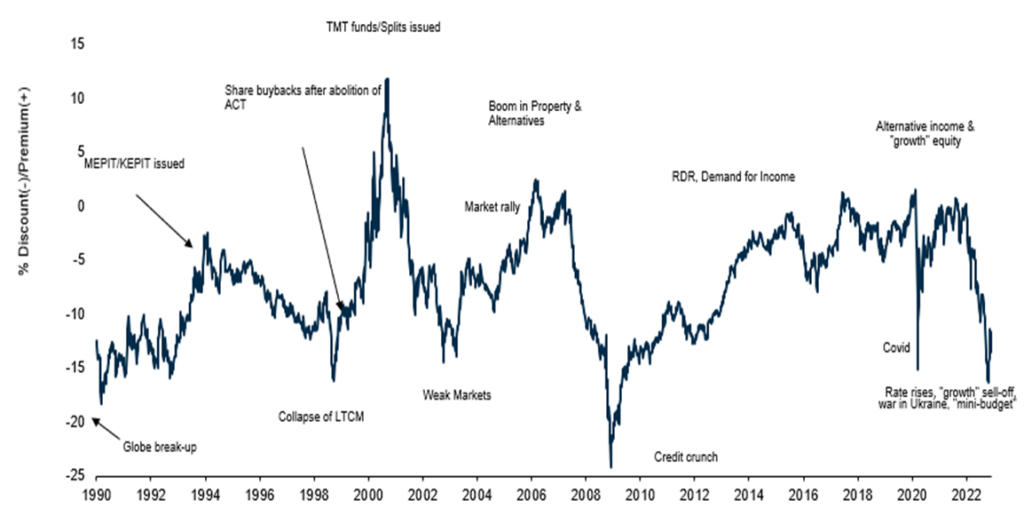

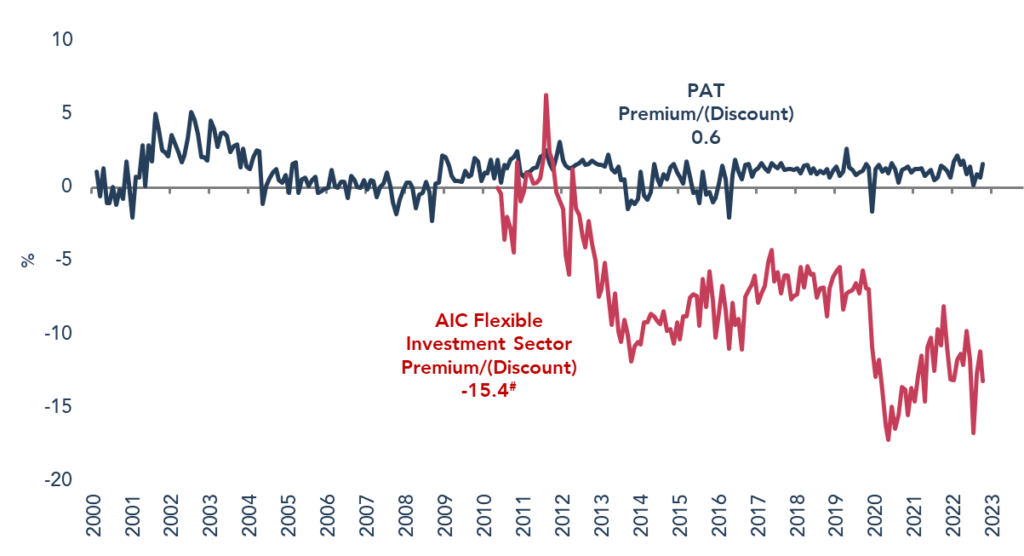

PAT’s DCM has been tried and tested, through the market turmoil of 9/11 in 2001, the Global Financial Crisis of 2008/9 and the pandemic in 2020. Despite these tests and more, PAT has not sold at a meaningful discount since 1999 (see Figure 2). Over this time, the Trust has grown from £68m to £1.9bn. This has benefitted shareholders by lowering the Trust’s ongoing charge ratio from c. 1.2% when Troy was appointed Investment Adviser in 2009, to 0.67% today (see Figure 3). Buying shares at a modest discount and issuing at a small premium also enhances the Trust’s NAV. This has provided over £17m of benefit to shareholders since 20091. Yet, in order to grow, we must be prepared to shrink.

Most importantly, minimising the discount enables shareholders to sell their shares when they need to at close to net asset value. Such sale decisions can often occur at moments of market stress, which is usually when discounts are at their widest. Boards need to recognise the changing nature of an investment trust’s shareholder base, which is increasingly comprised of private investors. Directors, in our view, have a responsibility to provide shareholders an exit at a time of their choice, without suffering the penalty of a discount.

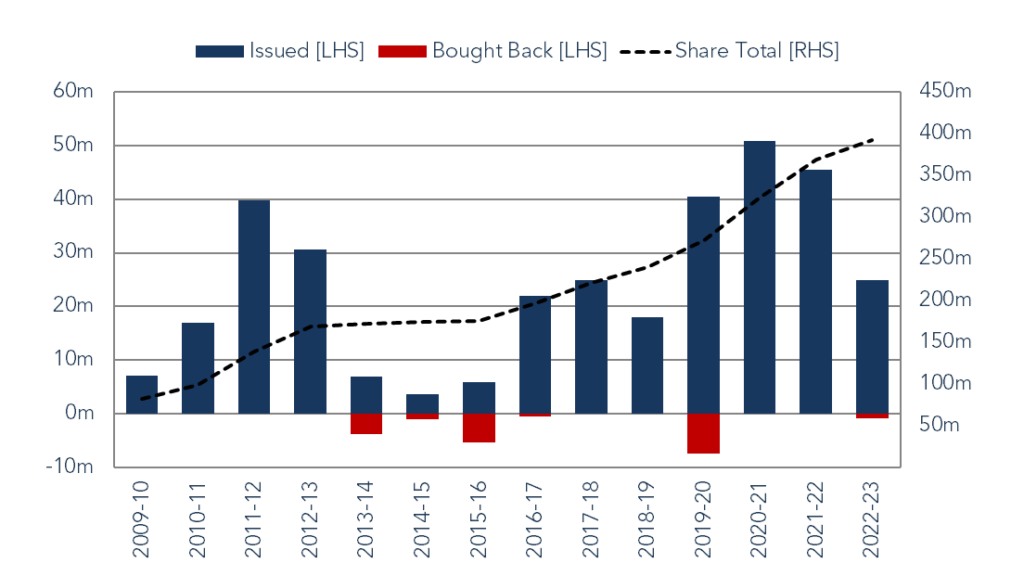

Equally important when thinking about facilitating the transactions of new and existing shareholders, DCMs help in improving investment trust liquidity. There are days and weeks when stock market liquidity dries up, as it did during the pandemic and during the mini-budget saga of last autumn. It is at times like these that Steven Budge and his team at Juniper Partners, who are responsible for the administration of the DCMs for all of Troy’s trusts, can step into the market to buy shares (see Figure 4). Our analysis shows that PAT, Troy Income & Growth Trust (‘TIGT’) and Securities Trust of Scotland (‘STS’) are more liquid than their respective peers of comparable size. This may be more important to some shareholders than others, but there is value in knowing that the exit exists.

It’s Not for Everyone

Of course, while a DCM may be appropriate for trusts invested in equities, fixed income and other liquid asset classes, it would not be suitable for those investing in illiquid assets such as private equity, smaller companies, alternatives such as renewables, music royalties and, the ultimate illiquid asset, property. And trusts of this type make up a greater proportion of the sector today.

Those using gearing aggressively may also have less flexibility to use buybacks. A falling market inherently increases gearing by reducing the value of the assets relative to fixed amount of debt; buybacks would exacerbate the problem. PAT has no structural gearing, and both TIGT and STS deploy sensibly low levels of gearing, via flexible bank lending. We have witnessed several incidents over the years of trusts being forced to suspend buybacks or reverse leverage at times of market stress. This may compound the matter.

Troy Trusts and DCMs

At Troy, we seek to be outward-looking. We are keen to advocate the benefits of DCMs to other fund management companies that manage investment trusts. I am always happy to meet managers of trusts to discuss the benefits of introducing a DCM.

Similarly, the PAT Board would be delighted to engage with other trust boards on the subject.

We believe this is all part of putting shareholders first.

Figure 1 – Investment company discounts widened in 2022

Past performance is not a guide to future performance. Source: Numis Securities, January 2023

Figure 2 – PAT Discount to net asset value

Past performance is not a guide to future performance.

Since sector established in 2010 Source: Refinitiv Datastream, 28 February 2023

Figure 3 – PAT ongoing charges ratio (‘OCR’) has fallen over time

Source: PAT Report & Accounts, 30 April 2022

Figure 4 – PAT shares in issue [RHS] – issuance & buybacks [LHS]#

Adjusted for Stock Split in 2022 Source: Juniper Partners, 31 January 2023

1Juniper Partners

Disclaimer

All information in this document is correct as at 9 March 2023. Please refer to Troy’s Glossary of Investment terms here. Performance data provided relating to the NAV is calculated net of fees with income reinvested unless stated otherwise. Overseas investments may be affected by movements in currency exchange rates. The value of an investment and any income from it may fall as well as rise and investors may get back less than they invested. The historic yield reflects distributions declared over the past twelve months as a percentage of the Trust’s price, as at the date shown. It does not include any preliminary charge and investors may be subject to tax on their distributions. Tax legislation and the levels of relief from taxation can change at any time. Any change in the tax status of a Trust or in tax legislation could affect the value of the investments held by the Trust or its ability to provide returns to its investors. The yield is not guaranteed and will fluctuate. There is no guarantee that the objective of the investments will be met. Shares in an Investment Trust are listed on the London Stock Exchange and their price is affected by supply and demand. This means that the share price may be different from the NAV.

Neither the views nor the information contained within this document constitute investment advice or an offer to invest or to provide discretionary investment management services and should not be used as the basis of any investment decision. Any decision to invest should be based on information contained within the Prospectus, Investor disclosure document the relevant key information document and the latest report and accounts. The investment policy and process of the Trust(s) may not be suitable for all investors. If you are in doubt about whether the Trust(s) is/are suitable for you, please contact a professional adviser. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. Although Troy Asset Management Limited considers the information included in this document to be reliable, no warranty is given as to its accuracy or completeness. The opinions expressed are expressed at the date of this document and, whilst the opinions stated are honestly held, they are not guarantees and should not be relied upon and may be subject to change without notice. Third party data is provided without warranty or liability and may belong to a third party. Ratings from independent rating agencies should not be taken as a recommendation.

Please note that the Personal Asset Trust is registered for distribution to the public in the UK and to Professional investors only in Ireland.

All reference to FTSE indices or data used in this paper is © FTSE International Limited (“FTSE”) 2023. ‘FTSE ®’ is a trademark of the London Stock Exchange Group companies and is used by FTSE under licence.

Issued by Troy Asset Management Limited, 33 Davies Street, London W1K 4BP (registered in England & Wales No. 3930846). Registered office: Hill House, 1 Little New Street, London EC4A 3TR. Authorised and regulated by the Financial Conduct Authority (FRN: 195764) and registered with the U.S. Securities and Exchange Commission (“SEC”) as an Investment Adviser (CRD: 319174). Registration with the SEC does not imply a certain level of skill or training. The product described in this document is neither available nor offered in the USA or to U.S. Persons.

Copyright © Troy Asset Management Ltd 2023